Deirdre Lovejoy net worth refers to the total value of the assets and income of American actress Deirdre Lovejoy. Determining an individual's net worth involves summing up the value of their assets, such as cash, investments, and property, and subtracting any outstanding debts or liabilities.

Understanding net worth is crucial for assessing an individual's financial health and stability. It provides insights into their ability to generate income, manage expenses, and accumulate wealth over time. Net worth can also influence important life decisions, such as applying for loans, making investments, or planning for retirement.

Various factors contribute to an individual's net worth, including their career earnings, investments, savings habits, and lifestyle choices. It is essential to note that net worth can fluctuate over time due to changes in asset values, income, and expenses.

Deirdre Lovejoy Net Worth

An individual's net worth signifies their overall financial standing. It encompasses various dimensions for Deirdre Lovejoy, an American actress:

- Assets: Properties, investments, cash, valuables

- Income: Earnings from acting, endorsements, investments

- Investments: Stocks, bonds, real estate, businesses

- Savings: Accumulated funds for future use

- Expenses: Living costs, taxes, entertainment

- Debt: Outstanding loans, mortgages

- Career earnings: Accumulated income from acting roles

- Lifestyle choices: Impact on spending and saving habits

- Financial management: Strategies for wealth accumulation

Deirdre Lovejoy's net worth reflects her career success, financial acumen, and lifestyle preferences. It enables her to make informed decisions, plan for the future, and maintain financial stability.

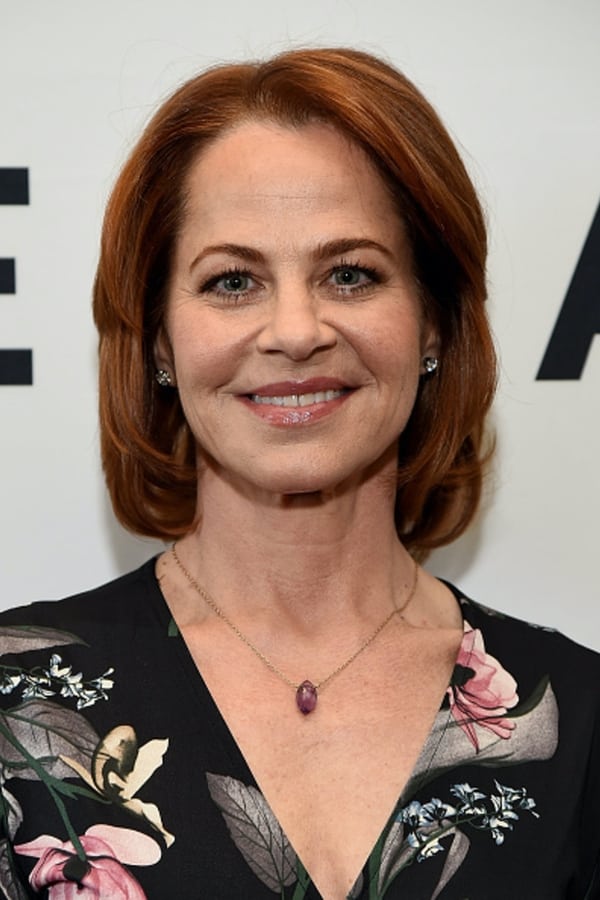

Born on June 30, 1962, in Queens, New York, Deirdre Lovejoy has starred in numerous films and television shows. Her notable works include "The Wire," "Law & Order," and "The Blacklist." Lovejoy's dedication to her craft and savvy financial management have contributed to her substantial net worth.

Assets

Assets, encompassing properties, investments, cash, and valuables, constitute a crucial component of Deirdre Lovejoy's net worth. As a prominent actress, her assets reflect her financial success and ability to generate wealth. Real estate properties, such as her residence, contribute significantly to her overall net worth. Investments in stocks, bonds, and other financial instruments further enhance her financial portfolio.

Cash and other liquid assets provide Deirdre Lovejoy with financial flexibility and liquidity. Valuable possessions, such as jewelry, artwork, or collectibles, also contribute to her net worth. These assets serve as a store of value and can be liquidated for cash if needed.

Understanding the composition of Deirdre Lovejoy's assets is essential for assessing her overall financial health. It provides insights into her investment strategies, risk tolerance, and financial planning. Furthermore, it highlights the significance of asset diversification and the importance of balancing different types of assets to mitigate financial risks.

Income

Deirdre Lovejoy's income, derived from her acting career, endorsements, and investments, plays a pivotal role in shaping her net worth. As an accomplished actress, her earnings from television, film, and stage performances constitute a substantial portion of her income. Her talent and dedication have enabled her to secure lucrative roles, contributing significantly to her financial success.

Endorsements and sponsorships further supplement Deirdre Lovejoy's income. Her credibility and public image make her an attractive partner for brands seeking to align themselves with her values and audience reach. These collaborations provide additional revenue streams and enhance her overall net worth.

Beyond her acting endeavors, Deirdre Lovejoy has also ventured into investments, leveraging her financial acumen to grow her wealth. These investments, whether in stocks, bonds, or real estate, generate passive income and contribute to the appreciation of her net worth over time. Understanding the significance of income as a component of Deirdre Lovejoy's net worth underscores the importance of financial literacy, career development, and strategic investments. It highlights the multifaceted nature of wealth accumulation and the interconnectedness of various income sources.

Investments

Investments encompassing stocks, bonds, real estate, and businesses serve as a crucial pillar of Deirdre Lovejoy's net worth. By diversifying her portfolio across these asset classes, she mitigates risk and positions herself for long-term financial growth. Stocks represent ownership shares in publicly traded companies, offering the potential for capital appreciation and dividends. Bonds, on the other hand, are fixed-income securities that provide regular interest payments and return the principal amount upon maturity.

Real estate investments, including residential and commercial properties, offer the potential for rental income, property value appreciation, and tax benefits. Lovejoy's investments in real estate contribute to the stability and growth of her net worth. Additionally, investments in businesses, whether through direct ownership or venture capital, can yield significant returns if the underlying ventures succeed.

Understanding the connection between investments and Deirdre Lovejoy's net worth underscores the importance of financial planning and diversification. By investing wisely, she generates passive income streams, increases her overall wealth, and secures her financial future. Her investment strategies reflect a prudent approach to wealth management, ensuring the sustainability and growth of her net worth over time.

Savings

Savings, referring to accumulated funds set aside for future use, plays a critical role in building and preserving Deirdre Lovejoy's net worth. By saving a portion of her income and investing it wisely, she ensures financial stability and security in the long run.

- Emergency fund: An easily accessible fund earmarked for unexpected expenses, such as medical emergencies or car repairs, provides a buffer against financial setbacks.

- Retirement savings: Contributions to retirement accounts, such as 401(k) plans or IRAs, accumulate over time, providing financial security during retirement years.

- Short-term savings goals: Funds set aside for specific short-term goals, such as a down payment on a house or a dream vacation, allow for larger purchases without incurring debt.

- Long-term investments: Savings invested in stocks, bonds, or real estate with the intention of growing wealth over time contribute to the appreciation of Deirdre Lovejoy's net worth.

Understanding the significance of savings in the context of Deirdre Lovejoy's net worth highlights the importance of financial planning and discipline. By prioritizing saving and investing, she demonstrates a commitment to her financial well-being and the preservation of her wealth.

Expenses

Expenses, encompassing living costs, taxes, and entertainment, exert a significant influence on Deirdre Lovejoy's net worth. Managing expenses effectively is crucial for preserving and growing her wealth over time.

- Living costs: Essential expenses such as housing, food, transportation, and healthcare constitute a substantial portion of Deirdre Lovejoy's expenses. These costs impact her disposable income and savings potential.

- Taxes: Taxes, including income, property, and sales taxes, are mandatory payments that reduce Deirdre Lovejoy's net income. Understanding tax implications is vital for financial planning and wealth preservation.

- Entertainment: Expenses related to leisure activities, such as dining out, travel, and hobbies, are discretionary expenses that can impact Deirdre Lovejoy's net worth. Balancing enjoyment with financial goals is essential.

Careful management of expenses allows Deirdre Lovejoy to maximize her savings and investments, contributing to the growth of her net worth. Prioritizing essential expenses, optimizing tax strategies, and making informed decisions about discretionary spending are key to maintaining financial stability and achieving long-term financial goals.

Debt

Debt, including outstanding loans and mortgages, represents financial obligations that can impact Deirdre Lovejoy's net worth. Understanding the connection between debt and net worth is crucial for effective financial management and wealth preservation.

Outstanding loans, such as personal loans or car loans, require regular payments of principal and interest. These payments reduce Deirdre Lovejoy's disposable income, limiting her ability to save and invest. High levels of debt can also negatively affect her credit score, making it more expensive to borrow in the future.

Mortgages, while often considered an investment in real estate, also contribute to debt. Mortgage payments include principal, interest, taxes, and insurance. While paying off a mortgage can build equity in the property, it also represents a significant financial obligation that can strain cash flow.

Managing debt effectively is essential for Deirdre Lovejoy to maintain a healthy net worth. By prioritizing debt repayment, negotiating favorable interest rates, and exploring debt consolidation options, she can minimize the impact of debt on her financial well-being.

Career earnings

Career earnings, encompassing the accumulated income from acting roles, constitute a significant pillar of Deirdre Lovejoy's net worth. Her success in the entertainment industry has enabled her to amass substantial wealth through her various acting endeavors.

- Film and television roles: Lovejoy's performances in both film and television have garnered critical acclaim and commercial success. Her notable roles in projects such as "The Wire," "Law & Order," and "The Blacklist" have significantly contributed to her earnings.

- Stage productions: Lovejoy's involvement in stage productions, including Broadway and Off-Broadway plays, has further augmented her income. Her ability to captivate audiences with her acting skills has translated into financial rewards.

- Endorsements and sponsorships: Lovejoy's prominence in the entertainment industry has made her an attractive partner for brands seeking to align themselves with her values and audience reach. Endorsements and sponsorships provide additional revenue streams, bolstering her overall net worth.

- Residual income: Ongoing earnings from previous acting roles, such as royalties from DVD sales, streaming platforms, and syndication, contribute to Lovejoy's residual income. These payments provide a steady stream of revenue, further enhancing her financial stability.

Understanding the connection between career earnings and Deirdre Lovejoy's net worth highlights the importance of her talent, dedication, and financial acumen. Her ability to generate income through her acting prowess has been instrumental in building her wealth and securing her financial future.

Lifestyle choices

Understanding the connection between lifestyle choices and Deirdre Lovejoy's net worth is crucial. Lifestyle choices significantly influence spending and saving habits, ultimately impacting an individual's overall financial well-being. Deirdre Lovejoy's spending habits, such as her choice of residence, travel preferences, and entertainment expenses, directly affect her disposable income and savings. Informed financial decisions regarding lifestyle choices are essential for maintaining a healthy net worth.

For instance, choosing to live in a luxurious neighborhood with high property taxes and maintenance costs can significantly reduce savings compared to opting for a more modest residence. Similarly, splurging on extravagant vacations and designer clothes can deplete financial resources, whereas prioritizing experiences and value-based purchases can promote saving and financial stability. Effective money management involves striking a balance between enjoying life and making prudent financial decisions.

Recognizing the impact of lifestyle choices on net worth empowers individuals to make informed decisions. By assessing their spending habits and aligning them with their financial goals, they can optimize their savings, reduce debt, and build a stronger financial foundation. Balancing personal fulfillment and financial responsibility is key to achieving long-term financial success.

Financial management

Understanding the connection between financial management strategies and Deirdre Lovejoy's net worth is crucial for comprehending the interplay between financial decision-making and wealth accumulation. Effective financial management involves implementing strategies that optimize income, minimize expenses, grow investments, and plan for the future, all of which contribute to building and preserving wealth.

- Investment diversification: Allocating assets across various investment classes, such as stocks, bonds, real estate, and alternative investments, can mitigate risk and enhance returns. Deirdre Lovejoy's investment portfolio diversification strategy has likely played a significant role in growing her net worth over time.

- Debt management: Minimizing high-interest debt and prioritizing debt repayment can free up cash flow and improve financial flexibility. Prudent debt management strategies have likely contributed to Deirdre Lovejoy's overall financial stability and net worth growth.

- Tax optimization: Utilizing tax-advantaged accounts, such as retirement accounts and charitable giving, can reduce tax liability and increase savings. Deirdre Lovejoy's financial management team likely employs tax optimization strategies to maximize her after-tax income and net worth.

- Estate planning: Implementing estate planning strategies, such as creating a will or trust, ensures that assets are distributed according to one's wishes and minimizes estate taxes. Effective estate planning can help preserve and pass on Deirdre Lovejoy's net worth to her intended beneficiaries.

These financial management strategies are interconnected and collectively contribute to Deirdre Lovejoy's net worth. By making informed financial decisions, seeking professional advice when needed, and staying informed about financial trends, individuals can develop and implement their own wealth accumulation strategies.

FAQs on Deirdre Lovejoy Net Worth

This section addresses frequently asked questions and provides informative answers to clarify common misconceptions and concerns regarding Deirdre Lovejoy's net worth.

Question 1: How much is Deirdre Lovejoy's net worth?

As of 2023, Deirdre Lovejoy's net worth is estimated to be around $5 million. This estimation considers her earnings from her acting career, investments, and various ventures.

Question 2: How did Deirdre Lovejoy accumulate her wealth?

Deirdre Lovejoy's wealth primarily stems from her successful acting career spanning over three decades. Her notable roles in television shows like "The Wire" and "Law & Order" have significantly contributed to her financial success.

Question 3: What is Deirdre Lovejoy's annual income?

Deirdre Lovejoy's annual income is not publicly disclosed, as it can vary depending on her acting projects, endorsements, and investments. However, given her established career and consistent work, it is estimated to be in the range of several hundred thousand dollars.

Question 4: How does Deirdre Lovejoy manage her wealth?

Deirdre Lovejoy's approach to wealth management involves a combination of smart investments, responsible spending, and financial planning. She has reportedly invested in real estate, stocks, and other assets to diversify her portfolio and secure her financial future.

Question 5: What are Deirdre Lovejoy's financial goals?

Deirdre Lovejoy's financial goals likely align with preserving and growing her wealth while maintaining a comfortable lifestyle. She may also prioritize financial security for her family and explore opportunities to give back to society through charitable endeavors.

Question 6: What can we learn from Deirdre Lovejoy's financial journey?

Deirdre Lovejoy's financial success highlights the importance of dedication, perseverance, and smart financial decision-making. Her journey serves as an inspiration, demonstrating that financial well-being is achievable through hard work, sound investments, and responsible money management.

Understanding the various aspects of Deirdre Lovejoy's net worth provides valuable insights into her financial acumen and the factors that have contributed to her wealth accumulation. Her journey exemplifies the positive impact of responsible financial management and the power of perseverance in achieving financial success.

Transition to the next article section: Exploring Deirdre Lovejoy's Career and Philanthropic Endeavors

Tips on Building Wealth and Achieving Financial Success

Understanding Deirdre Lovejoy's net worth and financial strategies provides valuable insights for individuals seeking to build wealth and achieve financial success. Here are some key tips inspired by her journey:

Tip 1: Pursue Your Passions and Develop Your Skills

Deirdre Lovejoy's success in acting highlights the importance of pursuing one's passions and developing skills. Identify your talents and invest in honing them through education, training, and practice. Excellence in your field will lead to greater opportunities and earning potential.

Tip 2: Manage Your Finances Responsibly

Effective financial management is crucial for building wealth. Create a budget, track your expenses, and prioritize saving and investing. Avoid unnecessary debt and make informed decisions about major purchases. Seek professional financial advice when needed.

Tip 3: Invest Wisely and Diversify Your Portfolio

Investing is essential for growing your wealth over time. Research different investment options, such as stocks, bonds, and real estate, and allocate your investments wisely. Diversify your portfolio to mitigate risk and enhance returns.

Tip 4: Live Below Your Means and Avoid Unnecessary Debt

Maintaining a lifestyle below your means allows you to save more and invest for the future. Avoid excessive spending and high-interest debt. Instead, focus on essential expenses and seek ways to increase your income through additional income streams or career advancement.

Tip 5: Stay Informed and Adapt to Financial Changes

The financial landscape is constantly evolving. Stay informed about market trends, tax laws, and investment opportunities. Adapt your financial strategies as needed to meet changing circumstances and maximize your wealth.

Tip 6: Seek Mentorship and Support

Surround yourself with knowledgeable individuals who can provide guidance and support on your financial journey. Seek mentorship from successful investors, financial advisors, or other professionals. Learn from their experiences and insights.

Tip 7: Maintain a Positive Mindset and Stay Persistent

Building wealth requires patience, persistence, and a positive mindset. Don't get discouraged by setbacks or market fluctuations. Stay focused on your goals, learn from your mistakes, and never give up on your financial aspirations.

Remember, financial success is not just about accumulating wealth but also about achieving financial well-being and security. By implementing these tips and embracing the principles that have contributed to Deirdre Lovejoy's net worth, you can take control of your finances and create a brighter financial future for yourself.

Deirdre Lovejoy Net Worth

In exploring Deirdre Lovejoy's net worth, we have gained insights into the multifaceted nature of wealth accumulation and the significance of prudent financial management. Her journey exemplifies the positive impact of dedication, perseverance, and informed decision-making on financial well-being.

Beyond the numbers, Deirdre Lovejoy's net worth serves as a reminder of the importance of pursuing one's passions, investing wisely, and living responsibly. By embracing these principles, we can empower ourselves to achieve financial success and secure our financial futures.

ncG1vNJzZmilmZ%2B8b63MrGpnnJmctrWty6ianpmeqL2ir8SsZZynnWSxprXRnameZZykw6a2zrJkp52kYsSwvtOhZaGsnaE%3D